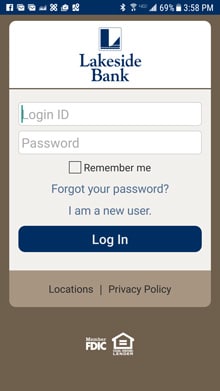

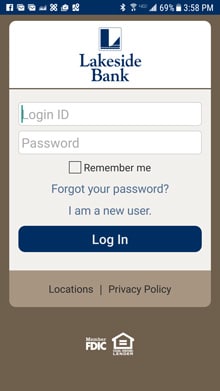

Lakeside eLink for iOS & Android

Convenient banking from your iOS and Android device! With Lakeside eLink® for iOS and Android, you can access your accounts whenever and wherever you want — it’s convenient, fast and secure. We designed Lakeside eLink® for the iOS and Android with all the built-in security features you’d expect. And we’ve made it easy to use and easy to set-up.

Lakeside eLink® for iOS and Android Banking features:

- See your available balances on checking, savings, loans, money market and certificate of deposit accounts

- View account history

- Transfer funds immediately to another Lakeside Bank account

- Make payments to loan accounts

- Receive account alerts and messages

Lakeside eLink® for iOS and Android Security features:

- Advanced encryption technology to prevent unauthorized access

- Privacy protection of your financial information. See the Privacy Policy for Customers.

- Safeguarded account numbers — we always mask them.

Download Lakeside eLink® for iOS and Android:

Enabling the Mobile Remote Deposit application:

- Download the App for your phone for iTunes or the Play Store if you have not previously.

- Log into Internet Banking.

- If you are not already enrolled in Mobile Banking, click the Mobile Link under the preferences tab, and check the box that says “Yes, enable my User ID and Password for use on my mobile device.”

- Under the Services tab on the left side, click on MOBILE CHECK DEPOSIT and accept the agreement.

- This will automatically enroll you in the remote deposit service and you may start depositing checks that are given to you by using your mobile device. It will allow you to make deposits to all accounts attached to your internet banking user.

Now your Lakeside Bank accounts are as mobile as you are! Bank whenever, wherever!

“iPhone” and "iOS" are registered trademarks of Apple, Inc.

“Android” is a registered trademark of Google, Inc.