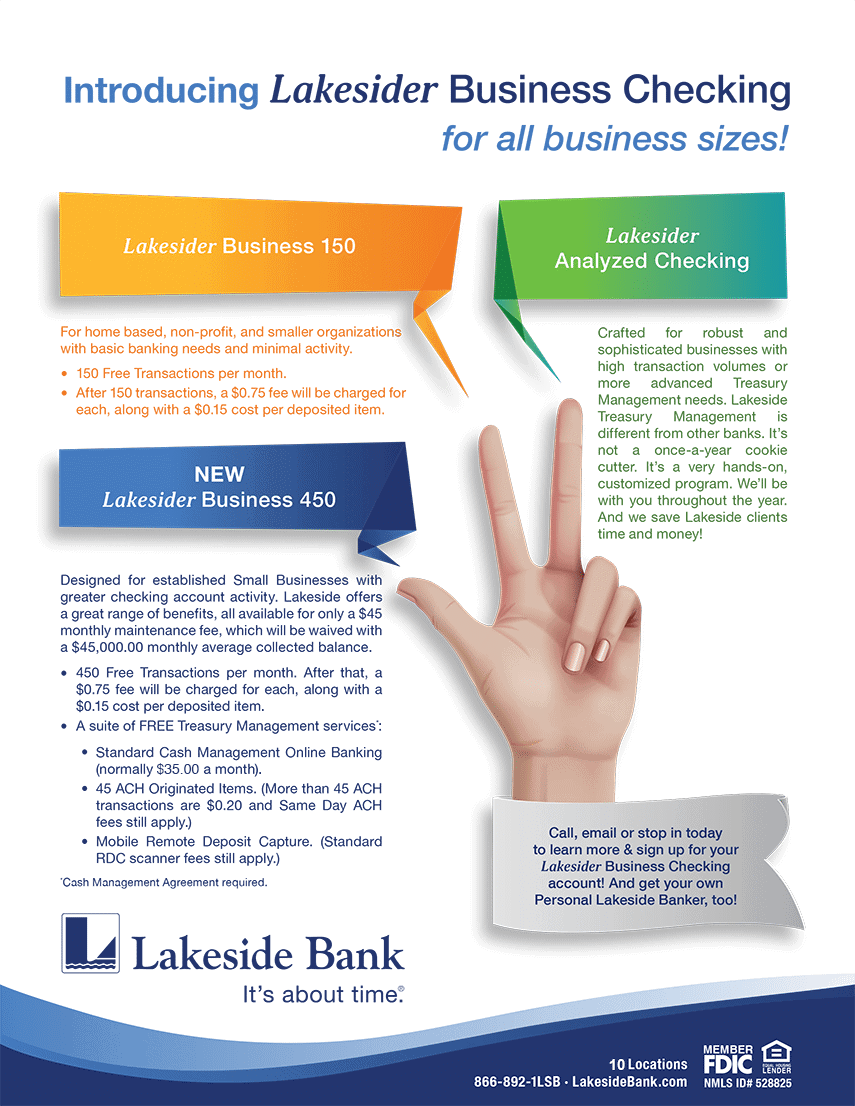

Lakesider Business 450

Designed for established Small Businesses with greater checking account activity. Lakeside offers a great range of benefits, all available for only a $45 monthly maintenance fee, which will be waived with a $45,000.00 monthly average collected balance.

-

- 450 Free Transactions per month. After that, a $0.75 fee will be charged for each, along with a $0.15 cost per deposited item.

- A suite of FREE Treasury Management services*:

- Standard Cash Management Online Banking (normally $35.00 a month).

- 45 ACH Originated Items. (More than 45 ACH transactions are $0.20 and Same Day ACH fees still apply.)

- Mobile Remote Deposit Capture. (Standard RDC scanner fees still apply.)

*Cash Management Agreement required.